Coronavirus Aid, Relief and Economic Security (CARES) Act

CARES was signed by the President on March 27, 2020.

The stimulus package was signed to provide financial relief to individuals, families, and businesses.

Helpful calculator for you to calculate your stimulus check.

The rebate is a one-time payment from the Federal Government and is mainly referred to as the stimulus checks.

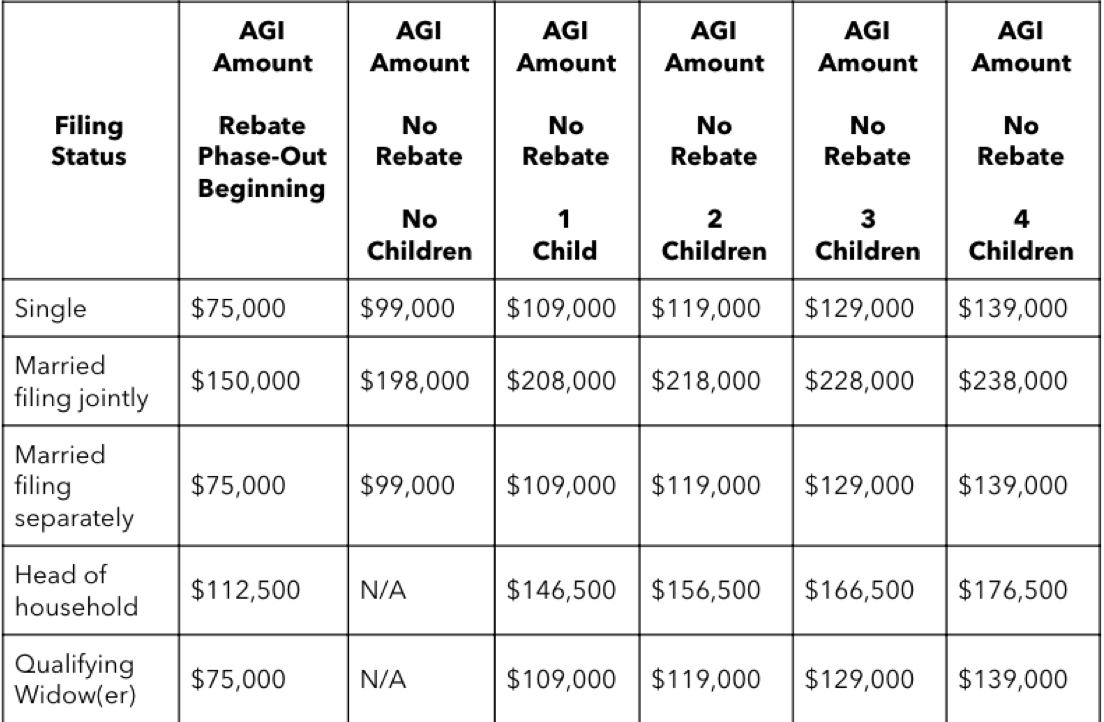

The amount is subject to income limitations – phase-out begins at $75K of AGI (Adjusted Gross Income).

See the screenshot below.

CARES was signed by the President on March 27, 2020.

The stimulus package was signed to provide financial relief to individuals, families, and businesses.

Helpful calculator for you to calculate your stimulus check.

The rebate is a one-time payment from the Federal Government and is mainly referred to as the stimulus checks.

The amount is subject to income limitations – phase-out begins at $75K of AGI (Adjusted Gross Income).

See the screenshot below.

How is income determined for the payment?

- Based on AGI on 2019 tax return if filed

- Else, based on AGI of 2018 if filed

- Else, based on 2019 Social Security or Railroad Retirement Benefits statement on file with the SSA

If you meet one of the criteria below should still file for 2019 tax return even if you are not required to do so

- Filed a 2018 return but have a new qualifying child or children since 2018

- Have a taxable income in 2019, even if under the filing threshold

You should not file a “zero” return to receive the rebate.

The following individuals are NOT eligible for a recovery

- Nonresident aliens

- Any individual who was claimed or could be claimed as a dependent on another individual’s 2019 income tax return

- Any individual who does not have a social security number

- Any qualifying child who has not been reported on a 2018 or 2019 tax return with a valid SSN

Will the recovery check need to be paid back?

- According to Congressional Research Service (CRS), no “when taxpayers file their 2020 income tax returns in 2021, they find that the advanced credit is greater than the actual credit, then they would not be required to repay the excess credit. In contrast, if the advanced credit is less than the actual credit, then taxpayers would be able to claim the difference in their 2020 income tax returns.

- It will be issued via direct deposit to individuals who have their banking data from a prior tax refund on file with the IRS.

- Individuals who filed a tax return in 2018 or later and requested their refund be issued via direct deposit for that year will be considered to have their banking information on file with the IRS.

- For those who do not have bank information on file, the Treasury Department is working on creating a web-based system to gather it.

- IF no bank information is provided via the above methods, a paper check will be issued.

Need help or more questions? Send me an email ([email protected]) or set up a tax consultation chat with me using this link.

I hang out a lot on LinkedIn. Feel free to connect or follow me on LinkedIn!

Need to talk to someone about your finances? Go ahead and set up a complimentary chat using this link.

RSS Feed

RSS Feed